- SMSF Setup

- Assets

- What is an SMSF?

- Benefits of SMSF

- Minimum Balance

- Legislation and Rules

- Education

- Sole Purpose Test

- Residency of an SMSF

- Financial Advice and Planning

- Choice of Fund

- ATO as Regulator

- Investment Property

- Investments

- SMSF Share Trading

- CFD’s

- Trusted SMSF Tax Return and Audit

- Imputation Credits in a SMSF

- Definitions

- Running

- SMSF Statistics from ATO

- Bank Accounts

- Macquarie Cash Management Account (CMA)

- Macquarie Online Trading

- Add a new Member to the SMSF

- Becoming an SMSF Trustee

- Preservation Age

- SMSF Accounting Melbourne

- Expenses in an SMSF

- Insurance

- Estate Planning

- Winding up an SMSF

- Transfer Benefits in Superannuation

- Actuarial Certificate SMSF

- SuperContributions Tax Increase on High Income

- Corporate Trustee Address Change

- Splitting with your Spouse

- Year end Requirements

- Packages for SimpleFund 360

- Contributions

- SMSF Pensions Phase

- SMSF Audit

- About Us

- SMSF News

- Home

- 3-Year Bring Forward Rule on Non-Concessional Contributions

3-Year Bring Forward Rule on Non-Concessional Contributions

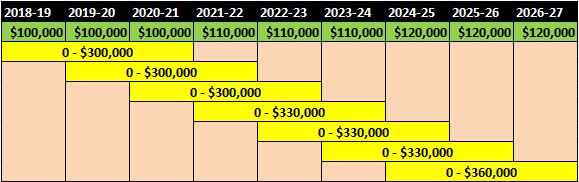

The 3-year bring-forward rule allows Members in an SMSF to contribute more than the Non-Concessional Contribution (after-tax Contributions) cap of $120,000 during a 3-year financial period from 1 July 2024. From 1 July 2021 to 30 June 2024, the non-concessional contributions cap was $110,000.

For more clarification, please see the example below:

Sam, who is 40, decides to make a Non-Concessional Contribution of $220,000 into his Super Fund in the 2024 financial year. Although this exceeds the annual Non-Concessional Cap of $110,000, he is able to make the contributions to his Super Fund without having to pay the excess contributions tax. This is because the total cap of the next 2 financial years (2025 and 2026) has been brought forward to 2023. Therefore, the amount that Sam contributed stays within the total Non-Concessional Cap of $330,000 ($110,000 x 3).

However, not the full amount of the 3-year bring-forward Non-Concessional Contribution cap needs to be utilised once triggered.

By bringing forward the caps of the next 2 years, members can make up to 3 years’ worth of non-concessional contributions in the First Year. Previously, this rule was only applicable to those under the age of 65 or 67. However, from 1 July 2022, this rule will now apply to those under the age of 75.

Bring-Forward Provision for People Under 75

If you are under 75 years old and you make excess non-contributions, the bring-forward rule will automatically be triggered and bring forward the next two years’ non-concessional contributions – but certain conditions apply. You can make a total of $360,000 over a three-year period as your non-concessional contributions if the bring-forward rule is triggered.

For Members with high total super balance at 30 June (i.e $1.68 million), the cap for non-concessional contribution will reduce. See more info here.

If you exceed your non-concessional contribution, the ATO will issue a letter to the Trustee and you may need to pay extra tax.

Note:

- Excessive concessional contributions (before-tax contributions) will count towards the non-concessional contributions cap and can trigger the bring-forward provision.

- Life insurance premiums and fund fees are considered as contributions

Bring-forward rule for individuals who are turning 75

From 1 July 2022, the bring-forward rule cannot be applied on Members who are aged 75 or over. The only contributions that the Fund can accept are mandated employer contributions and Downsizer contributions. In addition, the work test must be met by the Member in order to make mandated contributions to your SMSF. If the non-concessional cap is exceeded, Members may withdraw the excess amount from the Fund, otherwise the excess amount may be taxed at the marginal tax rate.

- Before you turn 75

If you are aged 74 years or younger on 1 July 2024, you can take advantage of the bring-forward rule for the entire Financial Year. This means that you can make a $360,000 non-concessional contribution in the Financial Year that precedes the year in which you turn 75, assuming that the bring-forward rule has not been triggered in the previous years. - After you turn 75

The only contributions that can be accepted by the Fund are Mandated Employer Contributions or Downsizer Contributions.

Have Questions?

Ask Superannuation Warehouse experts

Your Peace of Mind

Superannuation Warehouse is based in Melbourne and have clients throughout Australia. We deliver our SMSF administration services in an efficient and paperless way. This efficient service means a competitive fee to you. Our low ongoing fees will enable you to take control of your Super.

General Advice

Superannuation Warehouse is an accounting firm and do not provide financial advice. All information provided has been prepared without taking into account any of the Trustees’ objectives, financial situation or needs. Because of that, Trustees are advised to consider their own circumstances before engaging our services.

Address

Phone

Opening Hours

Monday to Friday

9.00am – 5.00pm