- SMSF Setup

- Assets

- What is an SMSF?

- Benefits of SMSF

- Minimum Balance

- Legislation and Rules

- Education

- Sole Purpose Test

- Residency of an SMSF

- Financial Advice and Planning

- Choice of Fund

- ATO as Regulator

- Investment Property

- Investments

- SMSF Share Trading

- CFD’s

- Trusted SMSF Tax Return and Audit

- Imputation Credits in a SMSF

- Definitions

- Running

- SMSF Statistics from ATO

- Bank Accounts

- Macquarie Cash Management Account (CMA)

- Macquarie Online Trading

- Add a new Member to the SMSF

- Becoming an SMSF Trustee

- Preservation Age

- SMSF Accounting Melbourne

- Expenses in an SMSF

- Insurance

- Estate Planning

- Winding up an SMSF

- Transfer Benefits in Superannuation

- Actuarial Certificate SMSF

- SuperContributions Tax Increase on High Income

- Corporate Trustee Address Change

- Splitting with your Spouse

- Year end Requirements

- Packages for SimpleFund 360

- Contributions

- SMSF Pensions Phase

- SMSF Audit

- About Us

- SMSF News

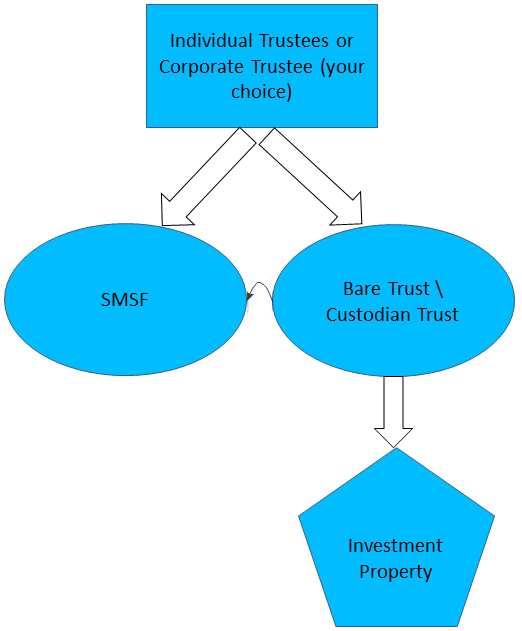

Related party loan is where the SMSF borrows money from a related party who is a Member or an associate of a Member of the SMSF. To secure the loan, a typical structure is required to set up as below:

The structure for the related party loan can be more cost effective. The related party loan can be simply held by the Bare Trust/Custodian Trust with Individual Trustees. Unlike a related party loan, if the SMSF intends to buy properties with bank loans, a Corporate Trustee and a Custodian Trustee are required to be set up by most Banks.

When we set up the related party loan structure for your SMSF, we will provide you with all the necessary documentation and also a loan schedule showing the loan details and the monthly repayment. The sample loan repayment schedule is noted below:

Arm’s Length & Commercial Terms

It’s important to ensure the terms of lending to the SMSF are on an arms-length basis and issued on commercial terms. This means the Members need to charge a reasonable amount of interests on the loan to the SMSF. The ATO provides the annual LRBA safe harbour interest rates as noted in the table below:

| Year | Real Property | Listed Shares or Units |

| 2024 – 2025 | 9.35% | 11.35% |

| 2023 – 2024 | 8.85% | 10.85% |

| 2022 – 2023 | 5.35% | 7.35% |

| 2020 – 2022 | 5.10% | 7.10% |

| 2019 – 2020 | 5.94% | 7.94% |

| 2018 – 2019 | 5.80% | 7.80% |

| 2017 – 2018 | 5.80% | 7.80% |

| 2016 – 2017 | 5.65% | 7.65% |

Conditions and circumstances for borrowing for an SMSF

A limited recourse borrowing arrangement (LRBA) involves an SMSF Trustee taking out a loan from a third-party lender. The Trustee has to use those funds to purchase a single asset (or collection of identical assets that have the same market value) to be held in a separate Trust. It is crucial to note that, an SMSF does not allow to purchase of any residential properties from a related party. The ATO provides the annual LRBA safe harbour interest rates for the unit assets under the loan.

The returns earned from the asset go to the SMSF Trustee. In case if the loan defaults, the lenders’ rights are restricted to asset apprehended in the separate trust. This means there is no recourse to the other assets held in the SMSF. An SMSF loan can be used to buy investment property. The returns on the investment – whether that’s rental income or capital gains – are funnelled back into the super fund, increasing your retirement savings.

Have Questions?

Ask Superannuation Warehouse experts

Your Peace of Mind

Superannuation Warehouse is based in Melbourne and have clients throughout Australia. We deliver our SMSF administration services in an efficient and paperless way. This efficient service means a competitive fee to you. Our low ongoing fees will enable you to take control of your Super.

General Advice

Superannuation Warehouse is an accounting firm and do not provide financial advice. All information provided has been prepared without taking into account any of the Trustees’ objectives, financial situation or needs. Because of that, Trustees are advised to consider their own circumstances before engaging our services.

Address

Phone

Opening Hours

Monday to Friday

9.00am – 5.00pm