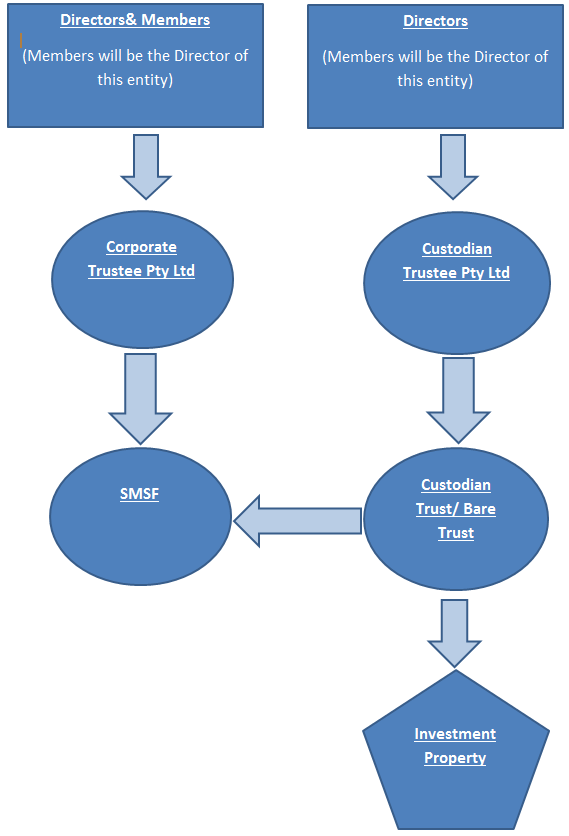

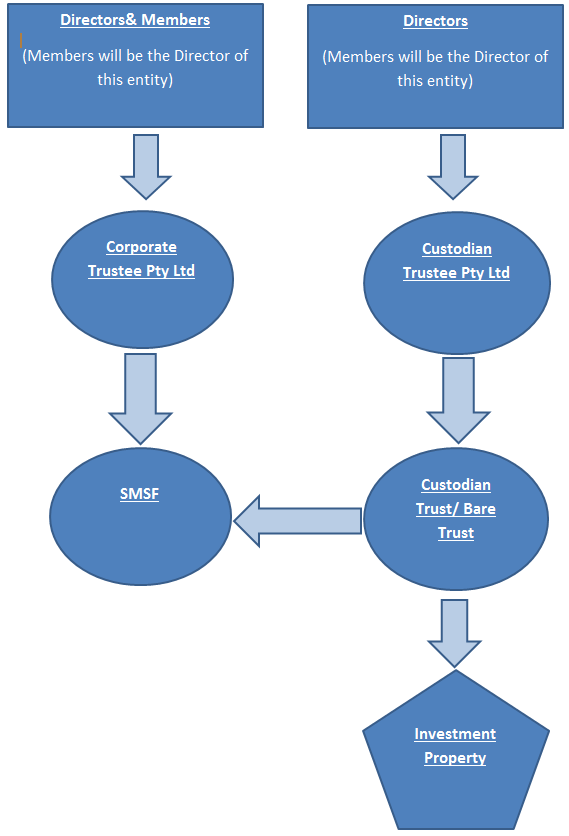

At Superannuation Warehouse, we are specialised in SMSF administration. We can execute the setup of a Bare Trust structure where the Trustees have decided to purchase a property with loans. The typical structure is set out below:

The SMSF can invest in commercial or residential property, but this cannot be your residence. You cannot have any dealings with a related party when investing in residential property, so you cannot live in the property, use the property as a holiday house or have a family member live in it. It should be for the investment as the sole purpose for your SMSF. Some important points regarding the use of an SMSF for property investment are as follows:

The SMSF can invest in commercial or residential property, but this cannot be your residence. You cannot have any dealings with a related party when investing in residential property, so you cannot live in the property, use the property as a holiday house or have a family member live in it. It should be for the investment as the sole purpose for your SMSF. Some important points regarding the use of an SMSF for property investment are as follows:

The SMSF can invest in commercial or residential property, but this cannot be your residence. You cannot have any dealings with a related party when investing in residential property, so you cannot live in the property, use the property as a holiday house or have a family member live in it. It should be for the investment as the sole purpose for your SMSF. Some important points regarding the use of an SMSF for property investment are as follows:

The SMSF can invest in commercial or residential property, but this cannot be your residence. You cannot have any dealings with a related party when investing in residential property, so you cannot live in the property, use the property as a holiday house or have a family member live in it. It should be for the investment as the sole purpose for your SMSF. Some important points regarding the use of an SMSF for property investment are as follows:

- To invest in property, it is important to set up the SMSF first, including the structure above. An SMSF itself cannot borrow money; therefore, a Bare Trust structure is put in place to facilitate the loans.

- The only purpose of the Bare Trust (also referred to as a Property Trust) is to keep title over the investment property until the loan is paid off.

- All property related costs can be paid by the SMSF.

- The SMSF receives rental income and pays for all operating expenses and loan repayments.

- Only one property can be added into a structure like this.

- The property will revert to the SMSF when the loan is repaid.

- Funds can be borrowed from the Trustees or the bank, or a combination of yourself and the bank.

- The loan type a bank would give the SMSF is a limited recourse loan, meaning the bank does not have a recourse on the SMSF should the loan default.

- For this reason banks usually ask for a personal guarantee over the property from Trustees.

- The maximum Loan to Valuation Ratios (LVR) is usually around 80% with residential property and 70% with commercial property when members guarantee the loans.

- When there’s a bank loan and a 60% LVR, the bank might not require guarantees from Trustees.

- The lender to the SMSF can be the Trustees as well, so you don’t have to use a bank.

- Trustees can borrow from the bank and then on-lend to the SMSF – this option might make the administration easier.

- The Bare Trust and Corporate Trustee are merely legal entities for holding the property and all transactions take place in the SMSF.

- Superannuation Warehouse charges a once-off fee to set up these entities, but there is no fee payable to Superannuation Warehouse for the maintenance of these entities as it is included in your monthly fixed fee.

Repair and Maintenance

When repairs and maintenance are undertaken in an investment property, these costs can be deducted in the SMSF. See these guidelines from the ATO for the difference in repairs vs. improvements.What name should the SMSF use with property investment?

Use the Custody Trust’s name, for example:- if individual trustee “John Summers ATF ABC Custody Trust”

- if corporate trustee “ABC Pty Ltd ACN number ATF ABC Custody Trust”

- when the SMSF uses an individual trustee, use the names of the individuals e.g. “John Summers and Sarah Summers”

- when the SMSF uses a corporate trustee, use the name of the corporate trust, e.g. “ABC Pty Ltd ACN number”